According to data from BitMEX, BlackRock's Bitcoin exchange-traded fund (ETF) has surpassed MicroStrategy's cryptocurrency holdings. According to data compiled by BitMEX Research, BlackRock’s IBIT holds 197,943 BTC, worth over $13.5 billion as of March 8, nearly 40 trading sessions after the United States Securities and Exchange Commission approved nine new funds on Jan. 10.

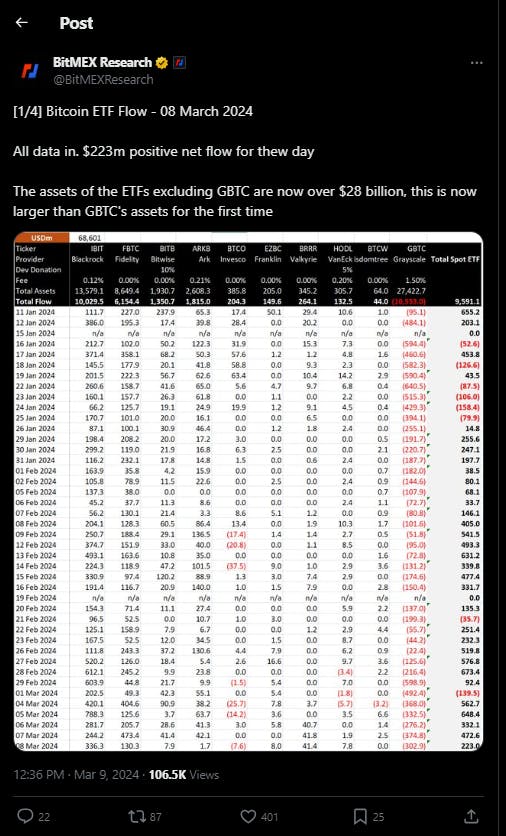

Excluding Grayscale’s GBTC, the newly launched Bitcoin ETFs collectively hold assets valued at $28 billion as institutional demand continues to drive the cryptocurrency upward. On March 8, Bitcoin’s price crossed the $70,000 mark for the first time.

The total assets held by the newly launched Bitcoin ETFs, excluding Grayscale's GBTC, amount to $28 billion, underscoring the increasing institutional demand driving Bitcoin's price upward. On March 8, Bitcoin has surpassed the $70,000 mark for the first time. Large-volume traders such as institutional investors are turning to public exchanges to fulfill orders, as over-the-counter (OTC) trading platforms are experiencing a shortage of Bitcoin.

While not an ETF issuer, MicroStrategy has amassed a portfolio of 193,000 BTC as part of its corporate treasury strategy. The software company employs a leveraged operating strategy, using debt to finance operations and investments. MicroStrategy recently announced plans for a debt offering to raise over $600 million to bolster its Bitcoin reserves, reaffirming its commitment to its Bitcoin-centric strategy. CEO Michael Saylor has expressed his unwavering belief in Bitcoin, stating that he has no plans to sell the company's Bitcoin reserves and views Bitcoin as the ultimate exit strategy. Saylor believes that Bitcoin is technically superior to traditional assets like gold, the S&P 500, and real estate and sees no reason to sell Bitcoin in favor of these assets.

Grayscale and Coinbase Engage with SEC on Spot Ether ETF

Grayscale and Coinbase have recently presented their proposal to the SEC, proposing the conversion of Grayscale's Ethereum Trust into a spot Ether exchange-traded fund (ETF). The meeting held on March 6 aimed to address concerns about potential market manipulation if the fund were to be approved. Coinbase presented compelling arguments suggesting that Ether has mechanisms, like Bitcoin, that significantly limit susceptibility to fraud and manipulation, similar to the reasoning behind Bitcoin ETF approvals.

Coinbase also emphasized its surveillance-sharing agreement with the Chicago Mercantile Exchange (CME), which was implemented for Bitcoin ETFs at the SEC's request to enhance trading monitoring. The correlation between Ether futures and spot markets was highlighted, drawing parallels with the Bitcoin market. Grayscale is proposing a second ETF for Ether futures trading, with the main difference between spot and futures markets being the immediate trading of spot market assets compared to contracts for future transactions in the futures market.

Several asset managers, including Invesco, Galaxy Digital, Fidelity, Franklin Templeton, and BlackRock, seek approval for a spot in Ether ETF. Final SEC decisions are anticipated in May, with some analysts suggesting that Grayscale might be using its futures ETF application as a strategy to encourage approval for its spot Ether ETF. Despite these developments, there remains uncertainty among asset managers about regulators' views on crypto investment vehicles.

Nigerian Cryptocurrency Community Shaken by Binance's Departure: A Crisis or an Opportunity?

Binance's departure from Nigeria has triggered concerns and potential opportunities within the nation's cryptocurrency community. Despite local figures like Nathaniel Luz anticipating the rise of new crypto exchanges to fill the void left by Binance's exit, the current prohibition on Binance's naira operations has sparked distress among local cryptocurrency stakeholders. This has caused fears about its possible repercussions on the livelihoods of many Nigerians and the potential escalation of youth unemployment in the country.

Nathaniel Luz, the CEO of Flincap, has noted that several Nigerian traders who relied on Binance for peer-to-peer trading are now grappling with the consequences. Despite the ban, some traders have sought refuge in alternative platforms, such as WhatsApp and Telegram groups, for their transactions. However, the ongoing ambiguity surrounding cryptocurrency regulation in Nigeria and the decision to halt Binance operations has raised doubts about the confidence levels within the Nigerian crypto space.

Oladotun Wilfred Akangbe, Chief Marketing Officer of Flincap, expressed concerns that these developments could lead to widespread fear, uncertainty, and doubt among Nigeria's crypto enthusiasts. Binance's recent statement regarding the automatic conversion of naira balances to Tether (USDT) and the discontinuation of naira deposits has added to the uncertainty. The Central Bank of Nigeria has raised suspicions about illicit transactions on crypto exchanges, including Binance, prompting increased regulatory scrutiny.

Despite these challenges, Nigeria's crypto community remains optimistic, hoping that new opportunities and exchanges will emerge to cater to the market's needs. However, the government and regulatory bodies must take the necessary steps to ensure a favorable environment for the growth of the cryptocurrency industry in Nigeria.